IRS Releases 2023 Key Numbers for Health Savings Accounts

The IRS has released the 2023 key tax numbers for health savings accounts (HSAs) and high-deductible health plans (HDHPs).

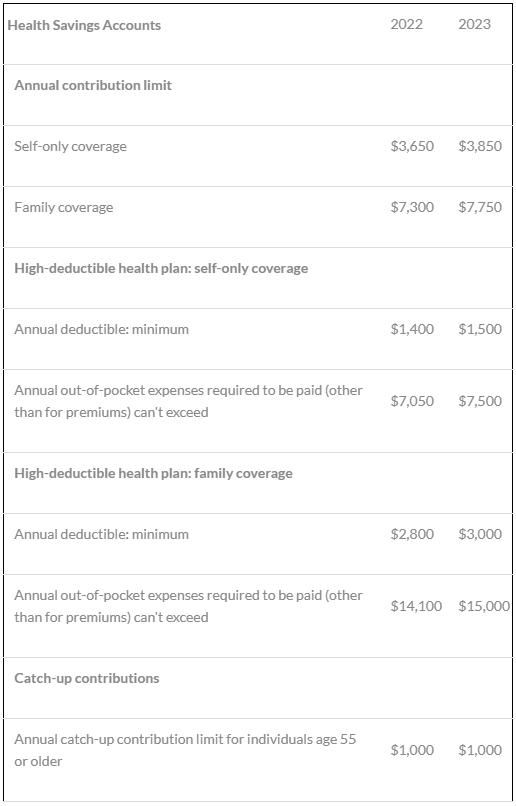

The IRS has released the 2023 contribution limits for health savings accounts (HSAs), as well as the 2023 minimum deductible and maximum out-of-pocket amounts for high-deductible health plans (HDHPs). An HSA is a tax-advantaged account that's paired with an HDHP.

An HSA offers several valuable tax benefits:

- You may be able to make pre-tax contributions via payroll deduction through your employer, reducing your current income tax.

- If you make contributions on your own using after-tax dollars, they're deductible from your federal income tax (and perhaps from your state income tax) whether you itemize or not.

- Contributions to your HSA, and any interest or earnings, grow tax deferred.

- Contributions and any earnings you withdraw will be tax-free if used to pay qualified medical expenses.

Here are the key tax numbers for 2022 and 2023.